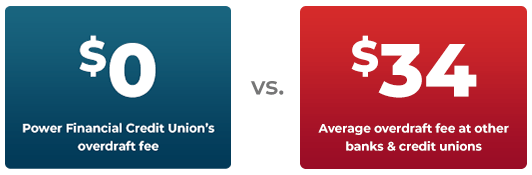

Securing our members’ financial well-being is one of our core values. But charging overdraft fees goes against that ideal, so we are proud to be the first credit union with no overdraft fees in South Florida. With the average overdraft fee being $34—a hit like that on an account could gouge our members, especially those who are more financially vulnerable.

Most of us have incorrectly balanced a checkbook, occasionally overspent, or had to pay suddenly for a large unexpected expense.

But with PFCU, you don’t have to worry about us charging a hefty fee on top of it all. We’re here to set you up for financial success—not failure.

If you’re wondering, “Do credit unions have overdraft fees” the answer is that most do. But not us. Unlike more profit-driven financial institutions like banks who prioritize the interests of their shareholders over their customers, we put our members first.

By eliminating overdraft fees and non-sufficient funds fees, we hope to make our members’ banking experience more accessible, inclusive, and forgiving.

-Rosa C., Miami Gardens, FL

There are two types of standard fees when you overdraft depending on whether or not the transaction is paid by your financial institution.

Member Referral Program

Credit Union Myths

The Role of Credit Unions in Wealth Management